Incidents and claims happen. Handling them properly and reporting them quickly protects your business and saves money. If you are experiencing a professional liability incident, you should report it to your insurance carrier as soon as you are aware of an incident.

Don’t ignore or conceal the claim. While you may hope it just goes away or are concerned about cost of defense, action is better than inaction in the event of a claim. At the first notice of a claim, lawsuit or potential claim, contact York Risk Services. We will obtain the necessary information to get your claims process started.

Even if the situation has not escalated to the point of a claim, discuss it with a claims specialist and report the situation as “Incident Only”.

This allows you to make a formal report of the incident while it is fresh in your mind. It also ensures your insurance company can obtain any important information, keep it on file and use it in your favor if it does become a claim in the future. Loss Reserves will not be established, allowing the event to stay off your loss run unless it escalates to a true claim situation.

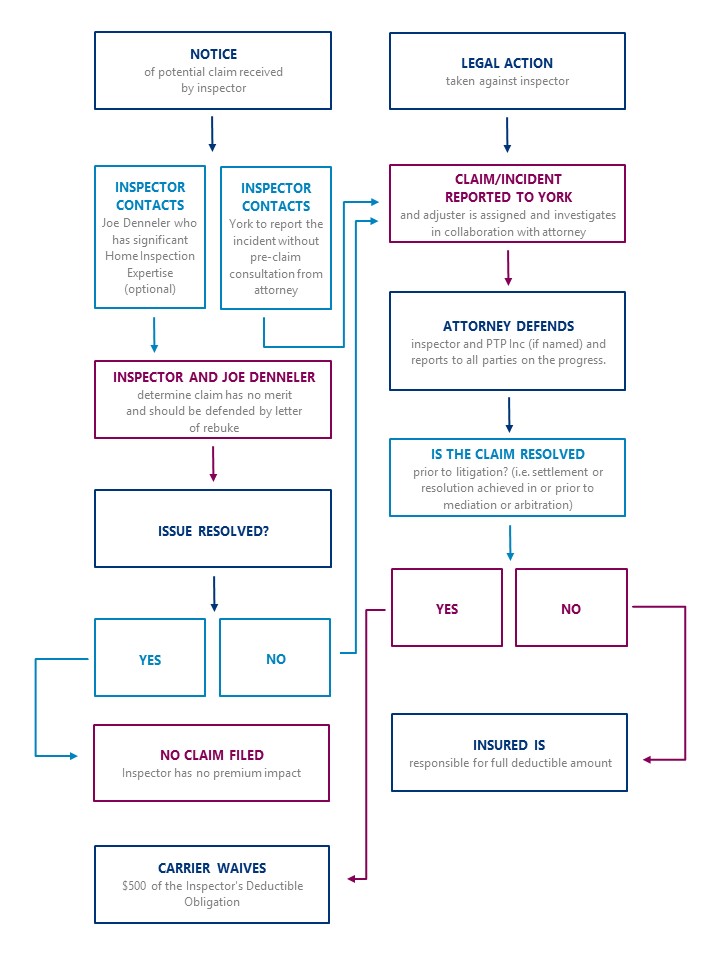

Explore the chart below to get an understanding of how claim reporting works within the Lockton Affinity Pillar to Post Franchisee Insurance Program.

While in an ideal world, a claim would never be filed against you, unfortunately, anything can happen. That’s why it is important to have Professional Liability Insurance to help your franchise cover the cost of certain legal fees that you may face as a result of claims and litigation brought against you for services you provide. Lockton Affinity has a complete insurance program to protect your franchisee from Property to Professional Liability Insurance.

Learn more at PillarToPostInsurance.com or contact us at (844) 456-1517.